SPAC Audit Specialists

MarcumAsia offers specialized audit and advisory services to support SPAC sponsors and SPAC targets in Asia.

MarcumAsia and our parent company, Marcum LLP, have been involved in more special purpose acquisition company (SPAC) transactions than any other audit firm. We are the only audit firm to have a dedicated SPAC team in Asia. MarcumAsia performs all audits for Marcum in Greater China, and MarcumAsia is a top-five auditor for Chinese companies listed in the U.S.

Our SPAC team has worked with SPAC sponsors, underwriters, and targets. We draw on wide-ranging experience with both the initial public offerings and subsequent business transactions consummated by such companies. MarcumAsia has designed our audit platform to deliver technical expertise, efficiency, and urgency required by SPAC IPOs. And we can provide high-quality, PCAOB-compliant audits for private companies that are contemplating entering a SPAC merger.

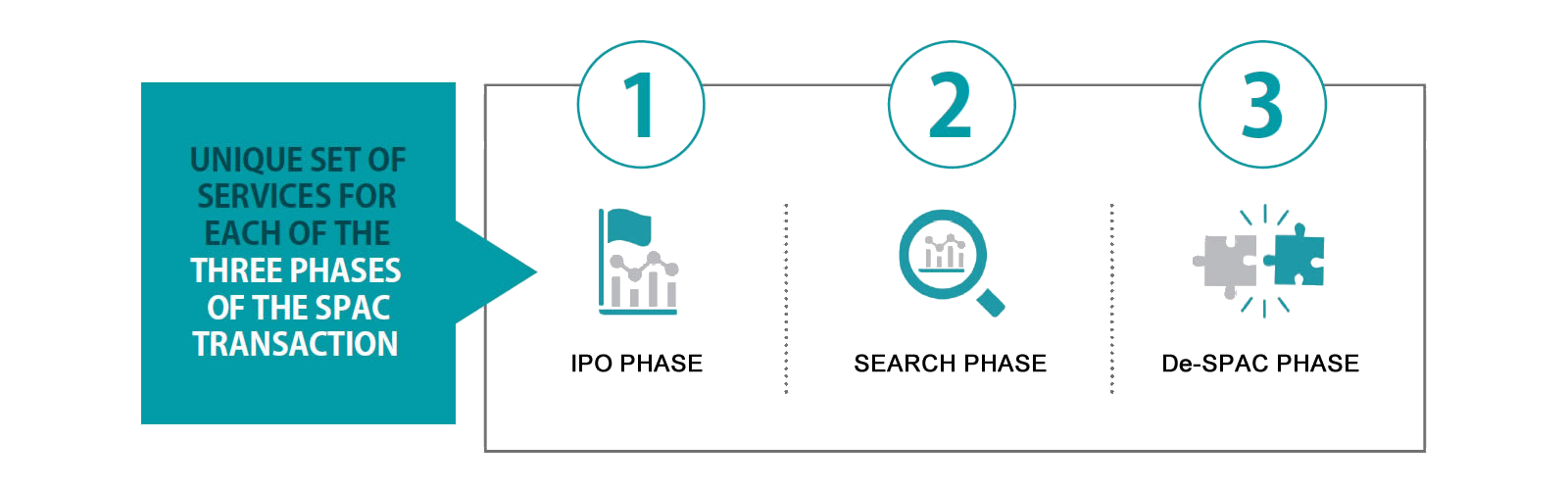

How SPACS Work | The MarcumAsia Advantage

MarcumAsia delivers the comprehensive audit and advisory services that SPACs require across their lifecycle to facilitate successful transactions for SPAC sponsor teams and private companies considering going public by way of a SPAC vehicle.

SPAC IPO Phase

Our highly efficient workflow enables MarcumAsia’s SEC practice to deliver timely, PCAOB-compliant audits for the SPAC initial public offering registration statement. Because our team has completed hundreds of special purpose acquisition company audits, we can anticipate and respond to SEC comments effectively. We also supply comfort letters to the underwriters and conduct a post-closing audit of the newly funded SPAC balance sheet filed on Form 8-K.

SPAC Search for Target / SPAC Compliance Phase

MarcumAsia will provide periodic reviews and annual audits for the public company as the SPAC management team or sponsors conduct their search for a compelling business combination target. Given the importance of timely audited financials to a successful SPAC merger, we can advise the PCAOB-readiness of a prospective private company merger candidate and provide fast-track audits for targets that do not have compliant audited financials.

Merger Approval & De-SPAC Phase

Following the business combination’s shareholder approval and consummation of the acquisition, MarcumAsia can provide ongoing SEC audits and quarterly reviews to the newly public company. Our extensive experience working with Asian companies and a strong team on the ground are decisive advantages in providing efficient service to enable timely reporting and instill public market confidence.

SPACs as the “New IPO”

Recently SPACs have emerged as a credible alternative to an initial public offering for high-growth private companies seeking access to the public markets.

Management teams should carefully evaluate if their investment story, growth strategy, internal capabilities are a good fit for a SPAC merger. Potential advantages include:

- An accelerated path to public status

- Sizable amounts of committed capital

- The potential value-add of experienced SPAC sponsor team

Given the complexity of the SPAC structure and highly negotiable economic terms, management teams should educate themselves and find experienced advisors attuned to the market’s rapid evolution. The target company not only needs to provide detailed financial information for a successful merger, but its management team also needs to be “public company ready” in a matter of a few months. Advanced preparation can place the private company in a much stronger position to attract quality SPAC teams and institutional investors in a concurrent PIPE transaction.

Deep SEC Experience with SPACs

MarcumAsia has a dedicated team providing audit services to SPACs based in Asia or evaluating potential Asian targets. We are among the very few firms that offer PCAOB-compliant audits in Greater China with a sizable team on the ground in Asia. MarcumAsia and our parent firm audit over 250 SEC registrants firmwide, and we have expertise in audits of internal controls to comply with Section 404 of Sarbanes Oxley.

Our Key Services

- Annual audits of SPAC IPOs and SPAC targets

- Quarterly reviews

- Registration statements

- Merger proxy statements

- Comfort letters

- PCAOB-readiness assessments

- Financial due diligence

SPACs in Asia

SPACs are becoming more widely embraced by private companies and the private equity and venture capital communities in Asia as an attractive way to raise capital and attain public status. Our fully integrated client service model for Asian SPAC audits includes a team of senior-level, bilingual audit professionals who are highly trained in SEC and PCAOB accounting principles and audit standards and well-versed in the realities of how business is done in China.

Operating out of five regional offices across China, our China team is backed by some of the industry’s most experienced technical and industry accounting experts from Marcum LLP. MarcumAsia’s audit quality is inspected by the Public Company Accounting Oversight Board (PCAOB) and enjoys established working relationships with the U.S. stock markets and regulators, including the Securities & Exchange Commission (SEC).

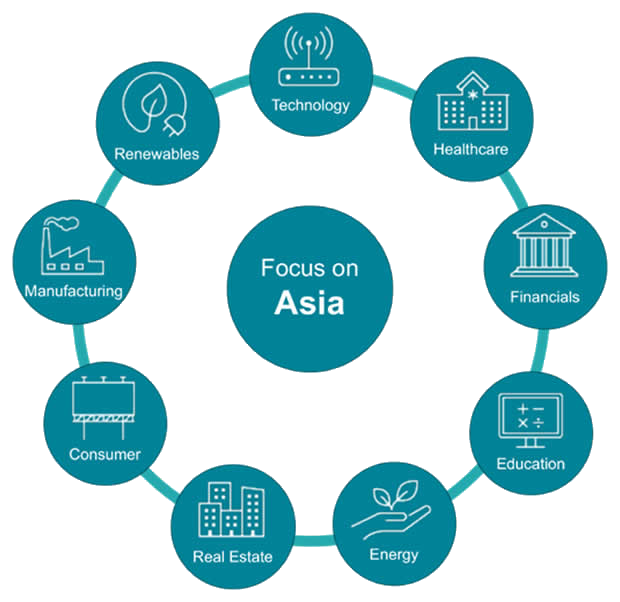

Broad Coverage of Industry Sectors

MarcumAsia has specialized expertise in the sectors that have seen high activity in SPAC mergers, including technology, healthcare, renewables, consumer, and education. We are familiar with the technical accounting issues that arise and are equipped to provide financial due diligence and audit readiness assessments of potential targets.

What are SPACs?

- SPACs Explained

- The term SPAC stands for "special purpose acquisition company," which are non-operating, publicly listed companies whose purpose is to identify and acquire a private company using funds raised during an IPO. SPACs can be attractive to some private companies as an efficient means to raise growth capital and achieve public status on an accelerated timeline. Private companies can negotiate the valuation of their company with the SPAC management, removing some of the cost and uncertainty associated with a traditional IPO. Following the merger, the acquisition target has publicly-traded stock and access to public market financing.

- SPACs Definition

- Some call SPACs "blank check" companies because investors buy shares in a shell company and bet that the SPAC management, or sponsors, will merge with a desirable private firm in the future, thus boosting the share price. SEC regulations require that SPACs have not identified any specific target before their IPO, so investors are essentially blind to what company they will eventually be investing in. However, in return, investors have the right to redeem their shares for the cash held in trust at the closing of the business combination. This feature makes SPACs an essentially no-lose proposition for investors who purchase the IPO and then choose to redeem their shares for cash.

- Are SPACs Publicly Traded?

- Yes, investors in the IPO receive a "unit," which typically consists of one common share, generally priced at $10, and a fraction of a warrant to purchase additional shares at a higher price. Shortly after the IPO, the unit typically separates so that both the common stock and warrants trade in the open market. The value of these securities can fluctuate based on market conditions and investors' expectations or rumors about the type of company that is likely to be acquired by the SPAC. This liquidity is an advantage that SPACs offer over traditional private equity investments, where investors have their capital tied up for five years or more.

- How Do SPACs Work?

A SPAC raises capital through an initial public offering (IPO) to acquire an existing operating company.

The rough timeline for a SPAC includes:

- SPAC Formation - The SPAC sponsors form a corporate entity and either commit their funds or find passive investors to cover the initial costs of the SPAC IPO and public company costs while searching for a target. In return, the sponsors and/or their backers receive warrants to purchase shares at favorable terms. The SPAC sponsors also can purchase shares equivalent to 20% of the IPO proceeds for pennies per share, providing them with what is known as the "promote." These shares are their primary equity compensation for sourcing and closing a deal.

- SPAC Team - SPAC sponsors need to find a lead underwriter confident about marketing their SPAC IPO. Typically, sponsor teams bring a track record of success in private equity, venture investing, M&A, operating public companies, or other relevant experience. More recently, some sponsor teams have included celebrities from the world of sports, entertainment, or politics who may be perceived as helpful in marketing deals to retail investors.

- SPAC IPO - The SPAC team works with the underwriters, legal advisors, and auditors to draft a prospectus that includes audited financials. Once the SEC registration statement is approved, the SPAC completes its IPO, typically raising between $40 million and billions of dollars. These funds are placed in trust and invested in liquid, interest-bearing securities to provide SPAC investors with the certainty of the return of capital should they choose to redeem.

- Search for SPAC Merger Target - Typically, a SPAC has between 18-24 months to find a private company to structure a business combination. This transaction is usually structured as a minority interest, although some SPACs acquired majority ownership in targets in the past. Because mergers can take several months to complete, most teams seek to secure deals well before the two-year mark.

- Negotiating the Transaction – Once the SPAC has found a suitable private company target, the two sides negotiate the key terms, including valuation, equity compensation for the target management, board structure, and the minimum capital requires to close a deal. Terms are formalized in a Definitive Agreement.

- PIPE Investment – Recently, most SPAC mergers include a PIPE (private investment in public equity) in which investors agree to take sizable stakes in the new combined entity. These deals are marketed on a confidential basis, and investors commit not to trade the securities or disclose the deal in advance. PIPEs can range from 50% to 100% of the value of the cash in trust and provide the target company with assurance as to committed capital that will be raised at the closing of the merger.

- Deal Announcement – Once the PIPE is negotiated, the deal is announced publicly. The SPAC sponsors and target management work to create excitement about the deal through meetings and investor relations activities. This information will usually be incorporated into an S-4 registration statement with extensive disclosures and audited financials for both entities. Once the registration statement has been reviewed by the SEC, the SPAC will set a date for SPAC shareholders to vote to approve or disapprove the transaction.

- De-SPAC – Assuming the transaction is approved, the merged entity will begin trading as a new public company with a new name and stock ticker.

- How Do SPACs Work for Investors?

- The funds raised during the IPO are placed into a trust account until the management team decides which company or companies it wants to acquire. Because investors retain the right to redeem their shares for the cash in trust, SPACs are a very low-risk proposition. If the SPAC sponsors fail to close a deal within the allotted timeframe, the SPAC returns the cash in its trust to shareholders, and sponsors lose their investment in the SPAC. For this reason, SPACs nearing the deadline are often more aggressive in pursuing a deal.

- Who Are SPAC Sponsors?

- SPAC sponsors tend to be experienced business executives with a background in closely related fields such as private equity, late-stage venture capital, or M&A combined with executives with operational experience and extensive networks. SPACs with the best managers have an increased likelihood of success thanks to extensive experience in the target industry of the SPACs, which provides access to proprietary deal flow. Some SPAC sponsors also develop very active retail investor followings, Chamath Palihapitiya being a good example. Notable celebrity SPAC sponsors include NBA Hall of Famer Shaquille O'Neal and Golden State Warriors star Stephen Curry, tennis champion Serena Williams, and former pro baseball player Alex Rodriguez. Former San Francisco 49ers player Colin Kaepernick formed a SPAC focusing on social justice, while Larry Kudlow and pop star Ciara have also taken part in the blank-check boom.

- Who Are SPAC Targets?

- SPACs look to combine with a target company that is double or triple the size of the amount of capital in the trust account, meaning that target companies with a private valuation lower than $150 million can have difficulty finding a SPAC with which to merge. Given the large number of SPACs above $300 million that have gone public in 2020 and 2021, there is intense competition for so-called "unicorns" with private valuations of $1 billion or more.

- Can SPACs acquire public companies?

- While there has been some discussion of using a SPAC to merge with a company trading at a lower valuation on an overseas exchange, this concept has not yet caught on as a practical idea.

- Why Do SPACs Have Warrants?

- A warrant is a contract that gives the holder the right to purchase a certain number of additional shares of common stock in the future at a specific price. A SPAC warrant provides the holder with the right to buy more shares at a premium to the stock price at IPO. Investors in the IPO typically receive a unit comprised of one share of common stock and a fraction of a warrant. As an example, if the unit includes half a warrant to purchase a share at $12, and the stock goes to $15, then the warrant someone who bought 100 units could acquire 50 shares at a profit of $3 per share.

The most common SPAC warrants are either public warrants or private placement warrants. The public warrants typically have a call feature to be repurchased by the company if the shares reach a pre-determined level. Following the IPO, the warrants will trade separately from the common stock, meaning that investors can sell or exercise the warrant while holding the common stock, or vice-versa, depending on their trading strategies. Warrant holders generally do not have voting rights. Since March 2020, 59 SPACs without warrants have been filed, 24 of which are currently trading. - Can SPACs Be Shorted?

- SPACs are attractive short targets for several reasons. They often have a relatively high market capitalization and somewhat fragmented shareholder base, making it easier to borrow shares to sell short, a fundamental component of short selling. SPACs are increasingly becoming targets for short-sellers, with the dollar value of bearish bets against shares of SPACs tripling in 2021 to about $2.7B. SPACs under investigation by the Securities and Exchange Commission and the Department of Justice are often targets of short campaigns.

- Can SPACs Drop Below $10 per share?

- Investors often ask can the common stock of SPACs go below $10 before the merger? Can SPACs go below $10 after the merger? Both are possible. SPAC shares can fall below their offer price if, for example, early investors need emergency cash and are willing to sell their shares at a loss to attract buyers quickly. That said, it's not very common for SPACs to trade very far below $10 before the merger since SPACs have a redemption feature that allows investors to exchange their shares for $10 held in trust plus interest. After the merger closes, the net asset value of the cash in trust no longer places a floor on the valuation. The price can plummet if investors believe that the deal is overvalued or if the company misses critical milestones.

- Are SPACs Audited?

- Yes, SPACs need to have audited financial statements and continue to issue financial reports every quarter post-IPO. The board of directors and audit committees must fulfill their respective professional responsibilities so that companies meet their obligations under the federal securities laws to provide investors with high-quality financial reporting at the time of the merger and on an ongoing basis. Once the SPAC has identified a merger target, the private company's financials must also have an audit performed to PCAOB standards contained in the S-4 registration statement. If the company has not been subject to PCAOB audits in the past, that can cause substantial delays in closing the deal.

- Where Can I Research SPACs?

- Research on what SPACs to invest in will help all parties evaluate the pros and cons of such specialized transactions. Discerning investors will want to know what SPACs are going public and what SPACs are available that have announced their merger targets. Subscribing to a SPACs newsletter with a SPACs calendar and a SPACs database will assist investors in determining which SPACs to look out for, sifting through which SPACs to watch Reddit for, and predicting what SPACs are going public in a given quarter.

- What Happens When SPACs Merge?

- When a SPAC successfully merges, the shareholders of the SPAC now become shareholders of the formerly private company, which will often begin trading under a news tock symbol.

SPACs with upcoming mergers can gain value when they close their mergers if investors believe the newly public company has attractive prospects, or they can fall through the "floor" set by the cash in trust if the market thinks the story is a dud. So it's beneficial to know what SPACs are merging soon and be aware that the option to redeem your shares for cash goes away once the entities merge. Resources like SPACTRACK.com offer valuable information listing SPACs without mergers, SPACs without targets, and SPACs ready to merge. After a merger is completed, shares of common stock automatically convert to the new business, offering SPACs and their targets an efficient avenue to publicly traded markets. - Can SPACs acquire multiple companies?

- Yes, but the level of complexity and the difficulty of valuation increases exponentially. More commonly, a SPAC will merge with a private company, and then the newly public company may use the proceeds from the SPAC trust and PIPE investment to make one or more acquisitions after the deal closes. Such a deal may be referred to as a "roll-up strategy" as it attempts to consolidate an industry and gain scale that will yield operating efficiency, pricing power, or both. However, successful roll-ups are notoriously hard to execute.

- Who Funds SPAC IPOs?

- In terms of who funds SPACs, a seasoned management team backed by a sponsor raises cash in an IPO and uses that capital to acquire a private company. SPACs can be attractive to a range of investors, including hedge funds who may apply leverage to juice up the returns and individual investors who find security in the certainty of having their capital returned, along with the potential to take part in an early-stage growth story.

- How Do PIPEs Work in SPACs?

- The relationship between SPACs and PIPEs is complementary. When a SPAC announces an acquisition target, it typically announces it is giving all the money raised in the SPAC IPO as well as what's called a PIPE (i.e., "private investment in public equity.") The PIPE serves two essential functions. First, it serves as a "price discovery" mechanism since sophisticated institutions validate the story and valuation by putting a sizable amount of capital to work. Second, it provides certainty to the private company as to the amount of committed capital that will be available at closing, no matter how many SPAC investors choose to redeem their shares for cash. For this reason, PIPEs have become a standard feature of most SPAC mergers. However, given the volume of deals coming to market, some SPACs may need to seek to close the merger without a PIPE or go "naked."

- How Are SPACs Valued?

- In the IPO, how SPACs are valued typically equates to $10 per unit. Unlike a traditional IPO of an operating company, the SPAC IPO price is not based on a valuation of an existing business but rather on the value of the cash held in trust, plus interest, discounted for the time value of money. Most SPACs tend to trade close to trust value when they first go public, the most notable increase being when a business combination is announced or when there are rumors of a business combination. SPACs may trade below net asset value (NAV) when the market sentiment turns bearish on SPACs or investors are forced to liquidate cash to meet other needs. There is significantly less downside risk investing in pre-merger SPACs close to or below NAV, given that investors can always choose to redeem.

- Why Are SPACs So Popular?

- A few years ago, SPACs were a fairly obscure path to obtain public status. The SPAC model has become popular because it fulfills a need for both firms going public and investors. What SPACs have been successful has primarily been determined by supply and demand. Given that private equity and venture firms have been investing in later-stage companies and making more significant investments, this has created a pool of so-called "unicorn" companies with valuations above one billion dollars. At the same time, investors have seen the early successes experienced by some SPAC mergers and viewed the SPAC as an opportunity to take part in companies entering the hypergrowth phase. While not all of these stories will be successful, the SPAC is now established as a well-accepted path to going public alongside the traditional IPO and the direct listing process.

Contact the MarcumAsia SPAC Team Today

Drew Bernstein

Co-Chairman

[email protected]

646.442.4811

Rong Liu

Partner

[email protected]

917.969.9309

Wechat: Rongliu75063

Stanley Liang

CPA - Assurance

[email protected]

646.442.4815

US Cell: 718.866.8185

China Cell: 181.3876.2738

Wechat: StanleyLiangNYC